How to Calculate Beta

Now suppose the researcher performs the exact same hypothesis test but instead uses a sample size of n 100 widgets. One of the most popular uses of Beta is to estimate the cost of.

Expected Portfolio Change Finance Investing Finance Weight

It will be more misleading if.

. For example beta decay of a neutron transforms it into a proton by the emission of an electron accompanied by an antineutrino. To calculate the Beta of a stock or portfolio divide the covariance of the excess asset returns and excess market returns by the variance of the excess market returns over the risk-free rate of return. On Wikipedia for example you can find the following formulas for mean and variance of a beta distribution given alpha and beta.

Get 247 customer support help when you place a homework help service order with us. SEC Form N-6F. Beta is a measure of how sensitive a firms stock price is to an index or benchmark.

Next subtract the risk-free rate from the markets rate of return. If a stock has a beta of 1 it. Learn how to calculate Beta on Microsoft Excel with this step-by-step tutorial.

If that sounds complicated read on to understand Beta in depth. Beta is a measure of the stocks volatility compared to the overall stock market Overall Stock Market Stock Market works on the basic principle of matching supply and demand through an auction process where investors are willing to pay a certain amount for an asset and they are willing to sell off something they have at a specific price. The Beta is calculated in the CAPM model CAPM Model The Capital Asset Pricing Model CAPM defines the expected return from a portfolio of various securities with varying degrees of risk.

How Do You Calculate the Beta of a Portfolio. Advantages of Using Beta Coefficient. However if it is not given it can be calculated if the currents Ib the base current and either Ie the.

How to Calculate the Beta Coefficient. It is calculated using regression analysis. To calculate the approximate yield to maturity write down the coupon payment the face value of the bond the price paid for the bond and the number of years to maturity.

Plug these figures into the ApproximateYTM formula then solve the equation as you normally would to get your answer. Because this is a forecast the accuracy of the CAPM results are only as good as the ability to predict this variable for the specified period. Beta of the asset β a a measure of the assets price volatility relative to that of the whole market Expected market return r m a forecast of the markets return over a specified time.

Calculate Beta for a Test with a Larger Sample Size. This means there is a 1611 chance of failing to detect the difference if the real mean is 490 ounces. Mufracalphaalphabeta and sigma2fracalphabetaalphabeta2alphabeta1 Inverting these fill out betaalphafrac1mu-1 in the bottom equation should give you the.

A thermistors b value or beta value is an indication of the shape of the curve representing the relationship between resistance and temperature of an NTC thermistor. Most people use the SP 500 Index to represent the market Beta is also a measure of the covariance of a stock with the market. Explanation of Levered Beta Formula.

NPV of the future cash flows of an investment and to further calculate its enterprise value and finally its equity value. Beta of 1. A beta of 1 means a stock mirrors the volatility of whatever index is used to represent the overall market.

To calculate the levered beta use the following steps. Unfortunately F-beta metrics was removed in Keras 20 because it can be misleading when computed in batches rather than globally for the whole dataset. The beta denoted as Ba in the CAPM formula is a measure of a stocks risk volatility of returns reflected by measuring the fluctuation of its price changes relative to the overall market.

It is widely used in investing financing sectors to improve the products services further. To calculate Beta or β you need to divide the variance of an equitys return by the covariance of a stock indexs return. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Or conversely a proton. A beta of 10 indicates that its volatility is the same as the benchmark. A filing with the Securities and Exchange Commission SEC that must be submitted by a company intending to file a notification of election to be subject to sections 55 through 65.

Calculate the BETA of MakeMyTrip in Excel using SLOPE and Regression Regression Regression Analysis is a statistical approach for evaluating the relationship between 1 dependent variable 1 or more independent variables. This simple yet easy to understand video provides you with the ability to ca. Read more Capital Asset Pricing Model for calculating the rate of return of a stock or.

Especially when training deep learning models we may want to monitor some metrics of interest and one of such is the F1 score a special case of F-beta score. Calculating the beta value is a vital step in the component selection process as it gives the characteristic at a given temperature vs the resistance for a specific. In nuclear physics beta decay β-decay is a type of radioactive decay in which a beta particle fast energetic electron or positron is emitted from an atomic nucleus transforming the original nuclide to an isobar of that nuclide.

Ideally the Beta will tell you the difference between a stock. Beta can give you an estimate of the stocks risk and some idea of market volatility. Thus the beta level for this test is β 01611.

How to Calculate β Beta of a Transistor β beta the gain or amplification factor of a transistor normally is given when solving a circuit equation. Where t is the tax rate. Here are two methods for calculating the beta of a private company.

Most Important Download Beta Calculation Excel Template. Information required to calculate the required pipe size. A beta greater than 1 indicates that the firms stock price is more volatile than the market and a beta less.

It also considers the volatility of a particular security in relation to the market. Finally divide the first difference by the second difference to. In simple words it is calculating the companys beta without considering the effect of debt.

In other words it moves in tandem with the benchmark. To calculate beta start by finding the risk-free rate the stocks rate of return and the markets rate of return all expressed as percentages. First its important to understand that beta is measured on a scale comparing an individual investment to a benchmark index like the SP 500.

Then subtract the risk-free rate from the stocks rate of return. A companys beta is a measure of its volatility compared to the broader market. Find out the Unlevered Beta Unlevered Beta Unlevered beta is a measure to calculate the companys volatility without debt concerning the overall market.

A process requires 5 000 kgh of dry saturated steam at 7 bar g. Beta β is a measure of volatility or systematic risk of a security or portfolio in comparison to the market as a whole. For the flow velocity not.

Pert Formula Earned Value Management Pmbok Cost Accounting

How To Calculate Beta Best Investment Apps Investing In Stocks Calculator

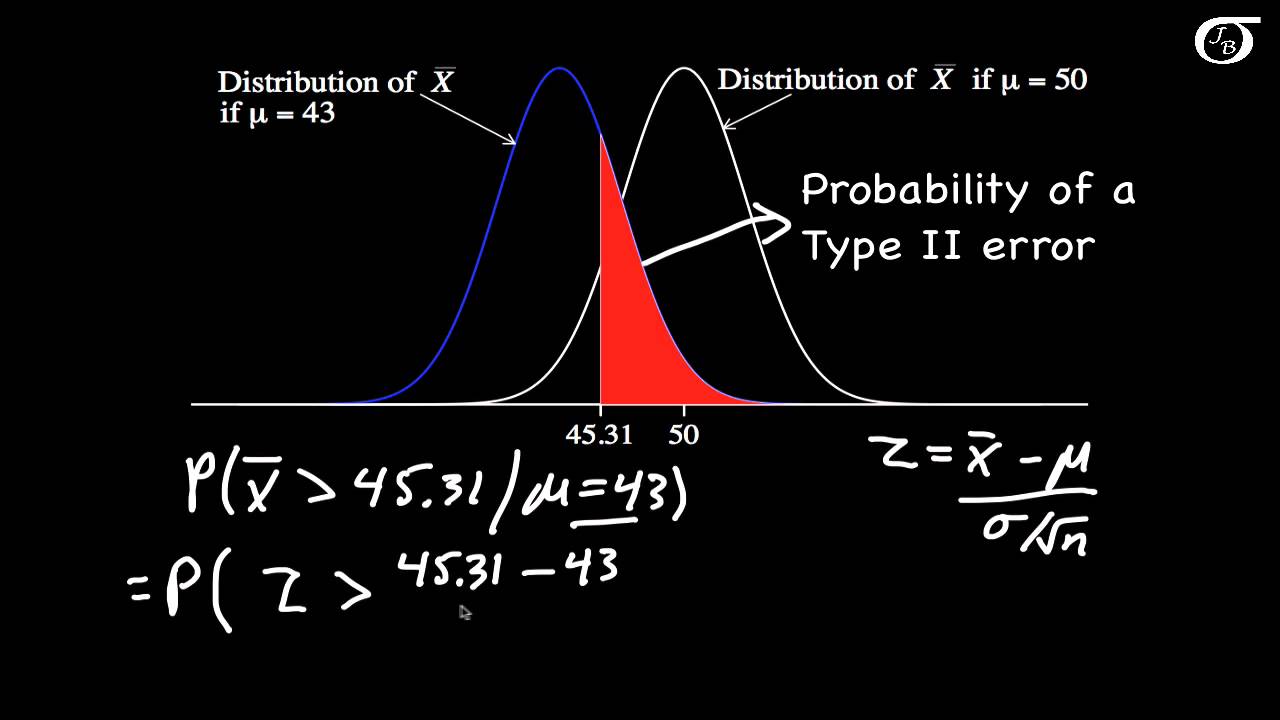

Calculating Power And The Probability Of A Type Ii Error A One Tailed Example Youtube Probability Power Error

What Is Stock Beta And How To Calculate Stock Beta In Python

Comments

Post a Comment